by Robert Schmad

Four members of Congress recently reported buying and selling financial assets, despite co-sponsoring a bill that would ban such trades, disclosures show.

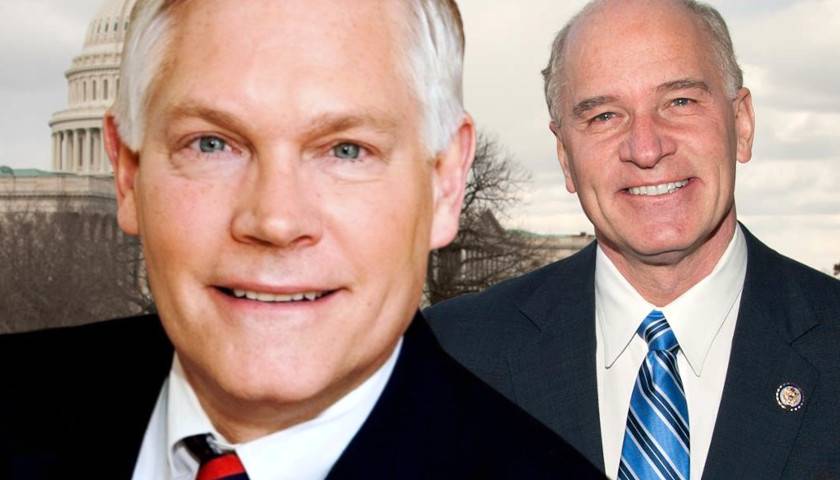

Democratic Reps. Mary Gay Scanlon of Pennsylvania, Jeff Jackson of North Carolina, Bill Keating of Massachusetts and Republican Rep. Pete Sessions of Texas all reported selling or purchasing assets after they signed on as co-sponsors of the TRUST In Congress Act, financial disclosures show. The TRUST In Congress Act would ban members of Congress from directly trading covered investments, which includes securities, commodities futures and similar assets by requiring them to place such assets in a blind trust.

Sessions and his wife were the most prolific traders of the bunch, according to his congressional financial disclosures.

The congressman and his spouse reported selling between $711,000 and $2 million in stocks after he co-sponsored the anti-trading legislation in January 2023, records show. Additionally, they reported purchasing between $6,204 and $62,204 in stocks during the same period.

Sessions and his spouse off-loaded large quantities of stock in Lockheed Martin, Blackrock, McDonald’s and Procter & Gamble, according to financial disclosures.

Session’s Lockheed Martin sale, worth between $100,000 and $250,000, was executed on Oct. 31, 2023, while he sat on the House Subcommittee on National Security, the Border, and Foreign Affairs, records show. Lockheed Martin is the largest defense contractor in the country, according to Bloomberg.

Session also sat on the House Committee on Financial Services while making trades. Session reported trading securities related to credit services and banking on his recent financial disclosures.

Other representatives co-sponsoring the TRUST In Congress Act moved significant, though smaller, quantities of assets.

Scanlon and her spouse sold between $30,000 and $100,000 worth of stock in two energy companies in May 2023, according to financial disclosures. Scanlon sits on the House Subcommittee on Administrative State, Regulatory Reform and Antitrust.

Stocks weren’t the only assets traded by representatives advocating to ban the practice.

Jackson, a freshman lawmaker not seeking reelection, sold between $2,000 and $30,000 worth of cryptocurrency on Jan. 29, 2023, just nine days after he co-sponsored the TRUST In Congress Act, records show.

Keating reported high dollar trading in both stocks and bonds after signing on to the TRUST In Congress Act as a co-sponsor in May 2023, disclosures show. The congressman reported buying between $126,000 and $490,000 in stocks and bonds after co-sponsoring the legislation.

Keating also reported selling between $65,848 and $275,848 in stocks and bonds during the same period, records show.

One congressman co-sponsoring the TRUST In Congress Act, while not trading stocks himself, backtracked after his wife’s investment firm bought and sold hundreds of thousands of dollars worth of individual stocks in September 2023, in violation of his personal policy, records show.

Arizona Democratic Rep. Greg Stanton acknowledged the purchase and sale of individual stocks and moved to transfer those assets to exchange-traded funds (ETFs), a pool of stocks generally tracking a specific market area, according to disclosures. He said that his wife’s firm was unaware of his policy and immediately requested that the stocks be sold and reinvested into ETFs.

The TRUST In Congress Act was initially introduced in 2020 by Virginia Democratic Rep. Abigail Spanberger and Texas Republican Rep. Chip Roy, legislative records show. The bill has since been reintroduced twice, in 2021 and again in 2023.

Seventy-three House members are co-sponsoring the legislation as of March 13, according to legislative records.

The offices of Scanlon, Sessions, Stanton, Jackson and Keating did not immediately respond to the Daily Caller News Foundation’s requests for comment.

– – –

Robert Schmad is a reporter at Daily Caller News Foundation.

Photo “Pete Sessions” by Pete Sessions. Photo “Bill Keating” by Bill Keating.